Portfolio Information

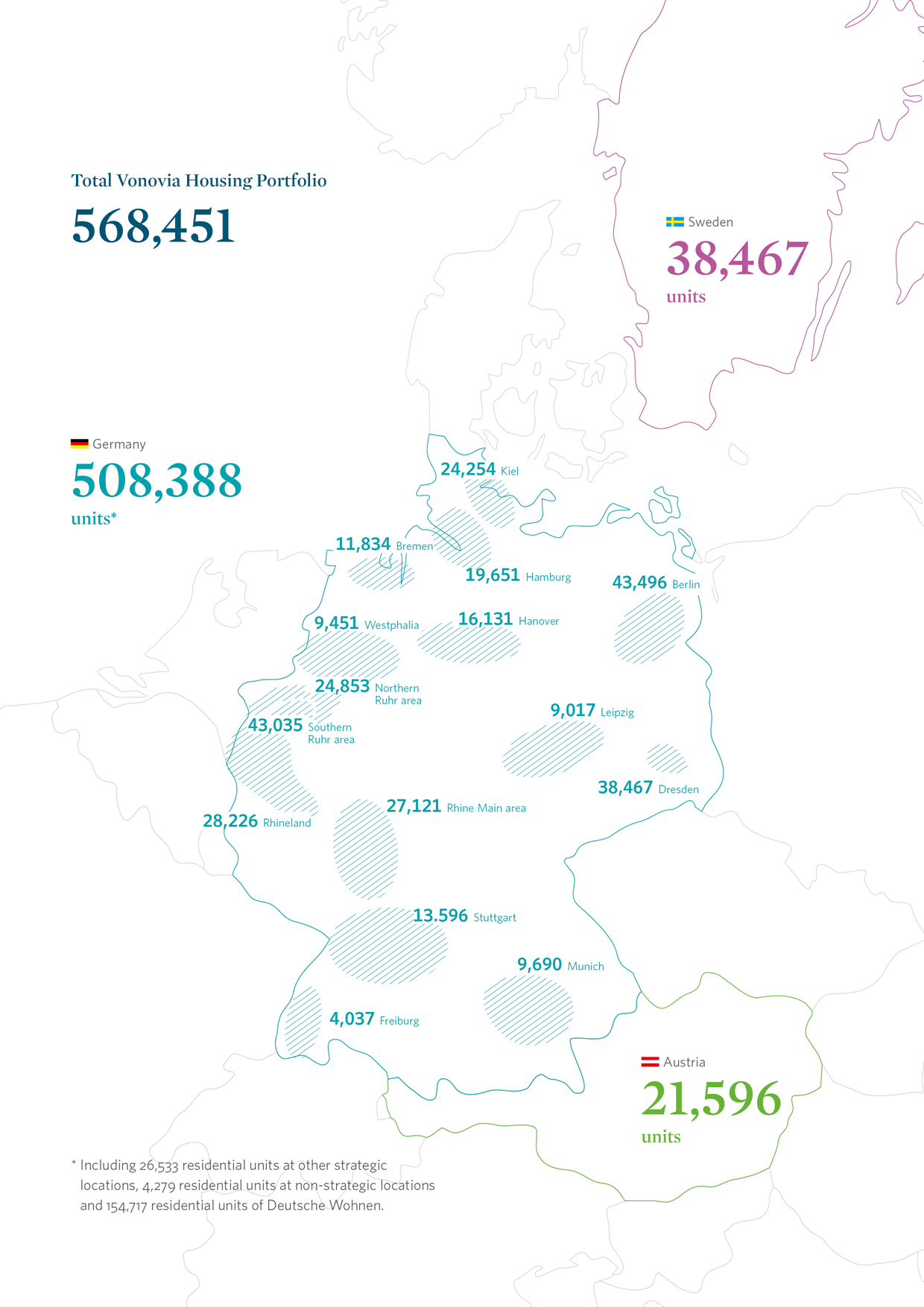

Vonovia manages its own real estate portfolio with a market value of € 95.4 billion as of September 30, 2021. The majority of our apartments are located in regions with positive economic and demographic development prospects.

Portfolio Structure | ||||||||||

Fair value* | ||||||||||

Sep. 30, 2021 | (in € million) | (in €/m²) | Residential units | Vacancy (in %) | In-place rent (in €/m²)** | |||||

Strategic | 48,104.6 | 2,305 | 328,140 | 2.5 | 7.12 | |||||

Operate | 16,336.7 | 2,290 | 107,401 | 2.5 | 7.51 | |||||

Invest | 31,767.9 | 2,313 | 220,739 | 2.5 | 6.94 | |||||

Recurring Sales | 4,106.6 | 2,468 | 24,458 | 3.0 | 7.25 | |||||

Non-core Disposals | 176.8 | 1,384 | 1,073 | 12.8 | 8.08 | |||||

Vonovia Germany | 52,388.0 | 2,312 | 353,671 | 2.6 | 7.14 | |||||

Vonovia Sweden | 7,017.6 | 2,350 | 38,467 | 2.4 | 10.34 | |||||

Vonovia Austria | 2,905.7 | 1,652 | 21,596 | 5.4 | 4.87 | |||||

Total | 62,311.3 | 2,274 | 413,734 | 2.7 | 7.34 | |||||

Deutsche Wohnen*** | 27,610.0 | 2,843 | 154,717 | 1.6 | 7.17 | |||||

In order to boost transparency in portfolio presentation, we also break our portfolio down into 15 regional markets. These markets are core towns/cities and their surroundings, mainly urban areas. Our decision to focus on the regional markets that are particularly relevant to Vonovia is our way of looking ahead to the future and provides an overview of our strategic core portfolio in Germany.

Breakdown of Strategic Housing Stock by Regional Market | ||||||||||

Fair value* | ||||||||||

Sep. 30, 2021 | (in € million) | (in €/m²) | Residential units | Vacancy (in %) | In-place rent (in €/m²)** | |||||

Regional market | ||||||||||

Berlin | 8,371.4 | 2,922 | 43,496 | 1.4 | 7.08 | |||||

Rhine Main Area | 5,434.4 | 3,083 | 27,121 | 1.9 | 8.76 | |||||

Southern Ruhr Area | 5,107.8 | 1,899 | 43,035 | 3.4 | 6.61 | |||||

Rhineland | 4,616.4 | 2,402 | 28,226 | 2.5 | 7.60 | |||||

Dresden | 4,564.3 | 1,991 | 38,467 | 3.8 | 6.44 | |||||

Hamburg | 3,442.9 | 2,700 | 19,651 | 1.6 | 7.59 | |||||

Kiel | 2,849.0 | 1,995 | 24,254 | 2.2 | 6.83 | |||||

Munich | 2,627.0 | 4,015 | 9,690 | 1.1 | 8.66 | |||||

Stuttgart | 2,442.7 | 2,811 | 13,596 | 1.8 | 8.34 | |||||

Hanover | 2,287.6 | 2,201 | 16,131 | 2.4 | 7.06 | |||||

Northern Ruhr Area | 2,056.4 | 1,328 | 24,853 | 3.1 | 6.11 | |||||

Bremen | 1,453.8 | 1,976 | 11,834 | 3.7 | 6.23 | |||||

Leipzig | 1,184.1 | 1,933 | 9,017 | 3.1 | 6.30 | |||||

Westphalia | 1,135.2 | 1,818 | 9,451 | 2.9 | 6.66 | |||||

Freiburg | 770.3 | 2,762 | 4,037 | 1.4 | 7.93 | |||||

Other Strategic Locations | 3,439.9 | 2,008 | 26,533 | 2.9 | 7.20 | |||||

Total strategic locations Germany | 51,783.1 | 2,321 | 349,392 | 2.5 | 7.14 | |||||

- * Fair value of the developed land excluding € 5,457.4 million, of which € 652.3 million for undeveloped land and inheritable building rights granted, € 833.6 million for assets under construction, € 923.8 million for development, € 1,261.0 million for nursing portfolio and € 1,786.6 million for other.

- ** Based on the country-specific definition.

- *** Based on definition of Deutsche Wohnen.

- **** Excl. Deutsche Wohnen portfolio.